I have created these 06 Free Amortization Schedule Templates using MS Word and MS Excel to give value to my website visitors. Please browse down to see Thumbnails & Download links for these Amortization Schedules.

An Amortization Schedule is a table that provides a detailed breakdown of each payment for an amortizing loan throughout its lifespan. An amortizing loan involves repayment of a loan at regular intervals whereby the initial amount borrowed decreases gradually until it is paid off fully in the end.

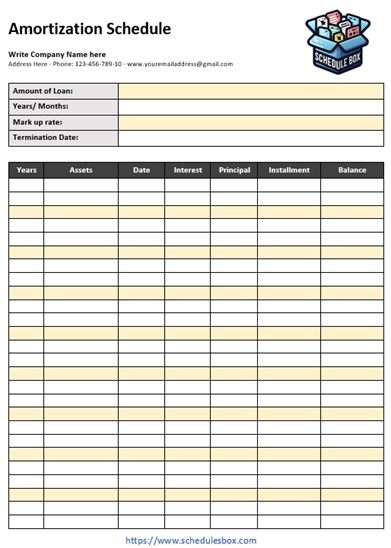

An amortization schedule would typically contain the following elements:

- Payment Date: It shows the time at which each payment must be made.

- Payment Amount: Displays the aggregate sum payable for each payment to be remitted.

- Principal Amount: This is the part of the payment that is credited toward the original amount of the loan.

- Interest Amount: This is the part of the payment that is credited toward the original amount of the loan.

- Total Interest Paid to Date: Cumulative interest is paid over the course of the loan.

- Remaining Balance: The remaining amount of the loan that has not yet been paid for each payment made.

Amortization schedules are frequently employed for instance in mortgages, car loans, and personal loans to make an understanding of each payment’s influence on one’s outstanding balance as well as total interest outlaid over time possible besides giving a financial snapshot of the loan.

Free Amortization Schedule Templates (MS Word & MS Excel)

Here is our collection of free Amortization Schedule Templates prepared using MS Word and MS Excel applications,

Types of Amortization Schedules

Amortization schedules can vary based on the type of loan, the structure of payments, and specific terms agreed upon by the lender and borrower. Here are some common types of amortization schedules:

- Standard Amortization Schedule:

- Fixed-Rate Amortization: The most common type where the interest rate remains constant throughout the life of the loan. Payments are equally distributed over the term, with early payments consisting mostly of interest and later payments primarily reducing the principal.

- Adjustable-Rate Amortization Schedule:

- Adjustable-Rate Mortgage (ARM): This schedule is used for loans with interest rates that can change over time. The schedule will adjust as the interest rate changes, affecting the amount of each payment and its division between interest and principal.

- Balloon Payment Amortization Schedule:

- Balloon Loan: This involves regular payments calculated as if the loan will be paid over a specific period, but a final “balloon” payment— a much larger payment — is due at the end of a shorter fixed period.

- Interest-Only Amortization Schedule:

- Interest-Only Loan: For a certain period, the borrower pays only the interest on the principal. After this period, the schedule reverts to standard amortization where payments include both principal and interest.

- Negative Amortization Schedule:

- Negative Amortization Loan: This schedule allows for payments that are less than the interest charged over a period, causing the loan balance to increase rather than decrease.

- Graduated Payment Amortization Schedule:

- Graduated Payment Mortgage (GPM): Payments start lower and gradually increase. The schedule reflects this change, typically designed to match increases in a borrower’s income.

- Custom Amortization Schedule:

- Custom or Flexible Payments: Some loans allow for customized payment plans, such as varying the payment amounts or frequencies according to the borrower’s cash flow.

There are a number of financial needs and situations that can be handled by different amortization schedules, each of which offers its own ways of assisting the debtors to control their repayment given their economic condition and future expectations.

Benefits of using our Amortization Schedule Templates

There are numerous advantages of using ready-made amortization schedule templates, particularly when it comes to individuals and business owners who want to handle their loans in an effective manner but are not required to make complex computations afresh. Here are some key advantages:

- Time Savings: Templates can be very useful to individuals who are not well versed in financial mathematics, as they help one avoid the hustle of coming up with the table as well as doing the computations.

- Accuracy: The reason why templates are generally made is to make sure that figures are right when making an amortization schedule yourself at home this way reduces the chances of mistakes. It’s important for financial planning and management of debts.

- Ease of Use: The majority of templates are simple to use and require you to input an insignificant amount of information – normally nothing more than the loan amount, interest rate, loan term as well as start date. Once these are keyed in, the template automatically breaks down every payment into principal and interest and also tells you the balance that remains once each payment has been made.

- Financial Planning: They help in seeing the whole life of the loan thereby enabling borrowers or financial managers to know how much time it will take them to settle their obligations, how payments are split between the principal amount and interest fee, and how the loan balance diminishes over time.

- Consistency: Standardized template aids in ensuring that all credits will be appraised and handled invariably making it advantageous to companies with numerous loans to deal with.

- Customization: There are multiple templates available that can be customized according to personal preferences. For instance, this includes increasing the amount of the installment repayments by adding supplementary payments on top of that stated in the agreement, changing the payment frequency from a monthly basis to a weekly basis or differently, as well as altering interest compounding methods.

- Educational Tool: When one is studying loans and amortization, the use of a template may act as a tool that helps to understand the structuring of loans and the computation of payments more easily.

Amortization schedule templates are a handy resource for anybody dealing with loans, be it an individual borrower, a money manager, or a professional in the banking sector. They provide a good mix of ease, dependability, and insight into financial responsibilities.